Falanqeeyayaasha Wall Street waxay kugula talinayaan iibinta Palantir Technologies in kasta oo ay kor u kacday AI

Brief news summary

Maalgashiga Palantir Technologies (NYSE: PLTR) wuxuu la yimid khataro waaweyn, inta badan sababtoo ah qiimaynta iibinta ee falanqeeyayaasha Wall Street ee saadaaliyay hoos u dhac ku dhowaad 30% ee qiimaha saamiyada. Inkastoo aragtiyadan taban, Palantir waxay la kulantay baahi xoogan oo loo qabo xalka AI ee gaar ahaan AIP, taasoo aragtay 55% korodhka dakhliga ee macaamiisha ganacsiga Mareykanka rubuca labaad. Si kastaba ha ahaatee, welwelku wuxuu sii jiraa iyadoo la eegayo qiimeynta sareysa, iyadoo saamigu uu ka ganacsanayo in ka badan 36 jeer iibka, taasoo si weyn uga badineyso celceliska taariikhiga ah. Tani waxay keentaa shaki ku saabsan joogtaynta kobaca Palantir. Macmiil kasta oo Mareykanku wuxuu soo saaraa celcelis ahaan $2.16 milyan oo dakhli ah, taasoo muujinaysa caqabado koraya iyada oo lagu jiro cadaadisyada qiimaha. In kasta oo qaar ka mid ah falanqeeyayaasha ay saadaaliyayaan heerka kobaca 30% iyo faa'iidooyin wanaagsan, badidoodu waxay u arkaan qiimeynta hadda jirta mid si xad dhaaf ah loo buunbuuniyay. Sidaa darteed, maalgashadayaasha waa inay dib u eegaan istaraatiijiyadooda; Maalgelinta Palantir hadda waxay noqon kartaa inaan la talin, iyadoo la tixgelinayo suurtagalnimada isbeddelka muhiimka ah ee saamiyada iyo caqabadaha dhaqaalaha ee socda.Ku tiirsanaanta kaliya bartilmaameedyada qiimaha ee falanqeeyayaasha Wall Street si loo qiimeeyo in shaydu yahay wax lagu iibiyo maaha talo wanaagsan. In kasta oo ay bixiso aragti ku saabsan dareenka suuqa, looma arki karo inay tahay tixraaca ugu dambeeya. Hadda, falanqeeyayaashu guud ahaan waxay talinayaan in la iibsado Palantir Technologies (NYSE: PLTR), iyadoo la tusaale qaadanayo qiimaha celceliska ah ee $27. 08—oo muujinaya hoos u dhac ku dhow 30%. Palantir wuxuu noqday ciyaaryahan weyn oo ku jira qaybta AI, oo laga dhisay AI tan iyo bilowgiisii. Markii hore diiradda lagu saaray xalka AI ee dowladda, waxay markii dambe ballaadhisay qaybta ganacsiga, halkaas oo macaamiisha dowladda ay weli ka yihiin 55% dakhliga. Dhowaan, baahida loo qabo Platform-ka Artificial Intelligence (AIP) ayaa kor u kacday, taasoo keentay in 55% kordhka sanadlaha ah ee dakhliga ganacsiga Mareykanka uu gaaro $159 milyan rubucii labaad. In kasta oo ay tahay guul, celceliska dakhliga Palantir ee macaamiisha Maraykanka waa in ka badan $2 milyan, taasoo xaddidaysa cabbirka suuqa marka la barbar dhigo tartameyaasha ka jira goobta software-ka-sida-adeeg (SaaS). In kasta oo dakhliga Q2 uu gaaray $678 milyan oo leh heerka faa'iidada ku dhawaad 20%, qiimeynta saamiyada waxay qabtaa walaac.

Iyadoo laga ganacsanayo in ka badan 36 jeer iibka, waxay u muuqataa mid si xad dhaaf ah loo qiimeeyay. Si Palantir uu u gaaro qiime macquul ah, waxay u baahnaan doontaa in ay sii wadato heerka kobaca 30% muddo shan sano ah, taasoo ah arinta adag. Madaama qiimayntan la buunbuuniyay, talada Wall Street ee ah in la iibiyo waa mid la fahmi karo. Inkastoo qaabka ganacsiga Palantir uu xoogan yahay, qiimaha saamiyada ma muuqato. Maalgeshayaasha waxaa lagula talinayaa inay iska ilaalaan in ay iibsadaan saamiyo dheeraad ah ilaa qiimeyntu ay ka noqoto mid macquul ah. Kahor intaadan maalgashan Palantir, ka fiirso in Taliye Saamiga Motley Fool uu aqoonsaday toban kayd oo kale oo ah maalgashi aad u wanaagsan waqtigan. Tan iyo 2002, Stock Advisor ayaa had iyo jeer ka fiicnaaday S&P 500, taasoo tilmaamaysa suurtagalnimada in faa'iido badan laga helo meelaha kale.

Watch video about

Falanqeeyayaasha Wall Street waxay kugula talinayaan iibinta Palantir Technologies in kasta oo ay kor u kacday AI

Try our premium solution and start getting clients — at no cost to you

I'm your Content Creator.

Let’s make a post or video and publish it on any social media — ready?

Hot news

Adobe ayaa iibsaday Semrush si uu u horumariyo fa…

Adobe ayaa qaaday tallaabo weyn oo ku saabsan suuq-geynta dijitaalka ah iyo falanqaynta iyadoo Iibsatay Semrush qiimihiisu yahay $1.9 bilyan oo doollar lacag caddaan ah.

Qalabka Wadahadalka Muuqaalka ee AI ayaa caan aha…

Marka shaqada fog ee sii balaadhaysa caalamka oo dhan, shirkaduhu si weyn ayay u qaadanayaan aaladaha shirarka fiidiyowga ee ku shaqeeya AI si loo xoojiyo isgaarsiinta iyo wada shaqaynta kooxaha kala firdhiday.

Mustaqbalka SEO: Isdhexgalka AI si loo xoojiyo ka…

Muuqaalka optimizing-ka mashiinka raadinta (SEO) ayaa hadda wajahaya isbeddel ballaaran oo qoto dheer sababtoo ah isdhexgalka sirdoonka artificial (AI).

Qaabka Sora ee OpenAI ayaa gaaray horumar muhiim …

OpenAI ayaa gaaray horumar weyn oo la taaban karo oo ku saabsan qaabka Sora, horumar casri ah oo ku saabsan abuurista muuqaalada qoraalka laga soo saaro, kaas oo si toos ah u beddelaya sharraxaadaha qoraalka ah muuqaalo tayo sare leh.

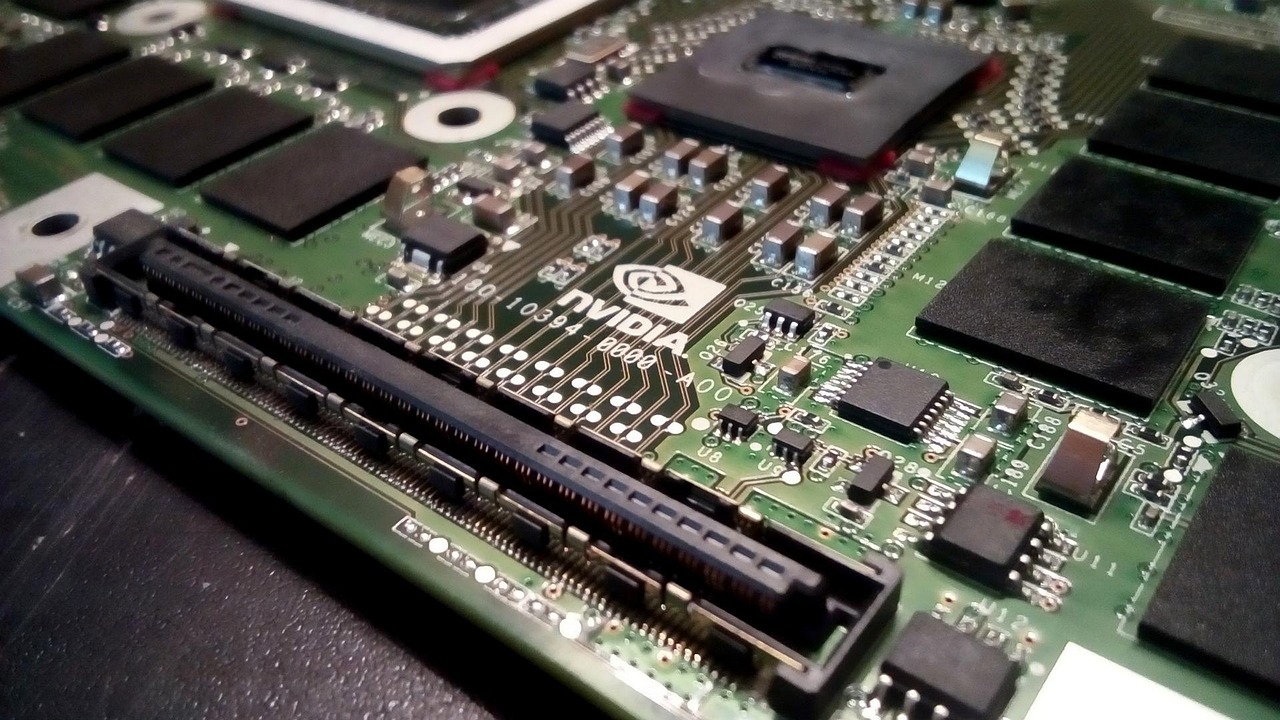

Iibinta chip-ka AI ee Nvidia ee Shiinaha ayaa hak…

Qayb muhiim ah oo ka mid ah goobtan ayaa ku guul darreystay inay soo degto.

Hagaajinta Makiinada Abuurista: Qaab-dhismeedka V…

In goobta si dhakhso ah isu beddelaya ee nuxurka dijitaalka ah iyo garaadka macmalka ah, kor u qaadida muuqaalka raadinta ee barnaamijyada muuqaalka ah ayaa leh caqabado waaweyn.

Adobe ayaa Iibsaday Semrush si loo xoojiyo Falanq…

Adobe Systems Inc., oo ah shirkadda weyn ee software-ka caalamiga ah ee loo yaqaan aaladaha hal-abuurka, waxay ku dhawaaqday inay soo iibsateen Semrush, oo ah bixiyaha ugu sareeya ee falanqaynta suuqgeynta dijitaalka ah iyo software-ka SEO.

AI Company

Launch your AI-powered team to automate Marketing, Sales & Growth

and get clients on autopilot — from social media and search engines. No ads needed

Begin getting your first leads today