None

Brief news summary

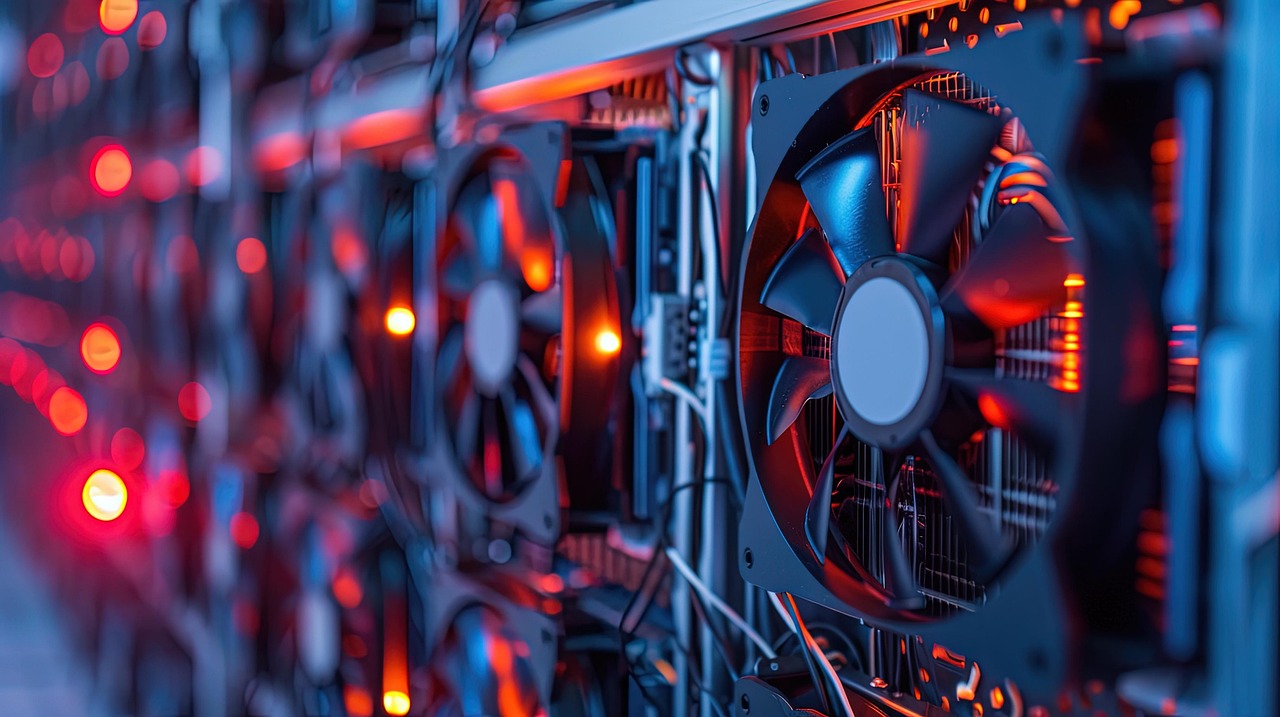

This is a summary of today's Morning Brief, which includes the chart of the day, what to watch and read, economic data releases, and earnings. While Nvidia remains in the headlines, the AI boom has also benefited utilities. Power companies are experiencing increased demand due to data centers, making them a part of the AI gold rush. The S&P 500 Utility Index has seen a strong rally this year, with Texas power company Vistra leading the way. Valuations for power companies remain attractive, but the growth potential is dependent on the development of energy infrastructure. There may be a period of digestion for AI-related hardware if power capacity cannot keep up with demand. However, some experts believe this is a timing issue rather than a long-term problem. Additionally, utilities may benefit from a decline in interest rates, as power stocks tend to trade inversely to yields.This is today's Morning Brief titled "The Takeaway. " To receive it in your inbox every morning, sign up along with the following: - The chart of the day - What we're watching - What we're reading - Economic data releases and earnings Although Nvidia (NVDA) has dominated the headlines this year, reaching a market cap of over $3 trillion, the AI halo effect has surprisingly benefited another industry: utilities. Typically considered a boring sector with regulated structures dictated by states, power companies are not known for significant growth. However, with the rise of AI and the subsequent demand for power in data centers, utilities have found themselves selling "shovels" into this gold rush, as stated by Sophie Karp, KeyBanc equity analyst. The S&P 500 Utility Index has seen a rally of over 10% this year, placing it behind only Communications Services and Information Technology. Leading the way is Texas power company Vistra (VST), which has more than doubled its value year-to-date, second only to Nvidia (NVDA) and Super Micro Computer (SMCI) on the S&P 500 leaderboard. Constellation Energy (CEG) also ranks high, boasting a nearly 70% gain. Karp notes that despite these gains, power company valuations remain historically attractive, thanks to their consistent earnings. However, there is a potential obstacle in the form of power capacity. Canaccord Genuity's George Gianarikas raised concerns about whether the energy infrastructure needed to support AI growth can be built quickly enough.

If power companies manage to meet the demand, significant progress can be expected. Otherwise, Gianarikas suggests there might be a period of digestion for AI-related hardware, emphasizing the need for action. Karp, on the other hand, dismisses these concerns as more of a timing issue than a major problem. She states that in some regions, capacity is already sufficient, while others may require additional capital investment and time to increase power production. Additionally, utilities may soon benefit from a decline in interest rates, which tends to have an inverse effect on power stock trading. If interest rates decrease before or during the Federal Reserve's eventual cuts, it could provide further opportunities for the sector. Julie Hyman, co-anchor of Yahoo Finance Live, brings you this Morning Brief every weekday from 9 a. m. to 11 a. m. ET. You can follow her on Twitter @juleshyman and read her other stories. Click here for in-depth analysis of the latest stock market news and events impacting stock prices. Read the most recent financial and business news from Yahoo Finance.

Watch video about

None

Try our premium solution and start getting clients — at no cost to you

I'm your Content Creator.

Let’s make a post or video and publish it on any social media — ready?

Hot news

TrendForce: AI Servers Boost Blackwell GPU Shipme…

According to the latest survey by TrendForce, the overall server market has recently reached a stage of stabilization, indicating a period of steady development and adjustment within the industry.

Who Is the Best AI Voice Agent for Sales in 2026?

Artificial Intelligence is revolutionizing how businesses engage prospects, making AI voice agents for sales essential tools for modern sales teams.

Meta Platforms Announces $10 Billion Investment i…

Meta Platforms Inc.

AI Video Marketing Strategies Boost Brand Engagem…

In the fast-changing world of digital marketing, artificial intelligence (AI) is becoming a powerful tool that helps marketers create personalized video content specifically tailored to target audiences.

Leveraging AI for Advanced Keyword Research in SEO

Keyword research remains a fundamental element of effective search engine optimization (SEO), and recent developments in artificial intelligence (AI) are reshaping this vital process.

Church Girl Marketing Launches 'The AI Genesis Ef…

Innovative Product Set to Transform Media Engagement for Spiritually Minded Audiences Dallas, Texas, Dec

AI Video Analytics Transforming Marketing Strateg…

In today's fast-changing digital environment, marketers increasingly rely on advanced technologies to gain a competitive advantage and create more impactful campaigns.

AI Company

Launch your AI-powered team to automate Marketing, Sales & Growth

and get clients on autopilot — from social media and search engines. No ads needed

Begin getting your first leads today