Liberate Raises $50M to Scale AI Automation in Insurance Operations

Brief news summary

Liberate, a San Francisco-based AI startup founded in 2022, has raised $50 million in Series B funding led by Battery Ventures, valuing the company at $300 million. The company specializes in automating property and casualty insurance processes using AI agents that handle quoting, claims, and endorsements through voice, SMS, and email. Its voice AI assistant, Nicole, autonomously manages calls, enhancing sales and customer service. By leveraging reinforcement learning tailored for complex insurance conversations along with human oversight for compliance, Liberate serves over 60 clients, covering 70-80% of the US P&C market. This AI automation has increased sales by 15% and lowered costs by 23%. Unlike add-on solutions, Liberate’s AI is fully embedded in core systems, enabling 24/7 interactions and drastically accelerating claims processing—for example, reducing hurricane claim handling from 30 hours to 30 seconds. With $72 million in total funding and about 50 employees, Liberate plans to improve AI reasoning and expand globally, aiming to grow monthly automated resolutions from 10,000 to 1.3 million. Co-founded by CEO Amrish Singh and industry experts, the company is transforming insurance operations through advanced AI technology.Liberate, an AI startup automating insurance operations, has secured $50 million in an all-equity funding round led by Battery Ventures, aiming to scale its AI deployments across global carriers and agencies. This round values the three-year-old San Francisco-based company at $300 million post-money, with new investor Canapi Ventures and returning backers Redpoint Ventures, Eclipse, and Commerce Ventures participating. The insurance sector, especially the non-life segment, has faced challenges such as rising operational costs, legacy system limitations, and growing customer demands. Deloitte reports that global premium growth in this segment is expected to slow through 2026 due to intensified competition, weaker rate momentum, and new cost pressures like tariffs. While AI experimentation among carriers has occurred, early initiatives struggled due to fragmented data and rigid workflows. Insurers are now embracing full-scale AI adoption, integrating it deeply into operations rather than as an add-on—a transition Liberate is addressing directly. Founded in 2022, Liberate focuses on AI systems for property and casualty insurers that enhance sales, service, and claims processes. Its voice AI assistant, Nicole, manages inbound and outbound calls to facilitate policy sales and service responses. Behind Nicole, a network of reasoning-based AI agents connects with insurers’ existing systems, collecting context and generating automated responses without human involvement. These AI agents complete end-to-end tasks such as quoting policies, processing claims, and updating endorsements, operating also across SMS and email channels to automate routine workflows. Co-founder and CEO Amrish Singh, who previously spent nearly four years at Metromile (a Lemonade-owned car insurance firm), emphasized the opportunity in overcoming the industry’s stagnant growth. He co-founded Liberate with Ryan Eldridge, VP of engineering and a former Metromile executive, and Jason St. Pierre, CPO with prior experience at Twitter, Google, and Alphabet’s Verily. Liberate’s AI solutions have boosted sales by about 15% and reduced costs by 23%, currently serving over 60 clients, primarily among the top 100 U. S.

property and casualty carriers and agencies that represent 70-80% of the market. The technology employs reinforcement learning tailored for long, regulated insurance conversations, ensuring every interaction is auditable and includes human-in-the-loop safeguards to comply with regulations. The startup has dramatically increased its automation volume from 10, 000 monthly tasks to 1. 3 million automated resolutions within a year, covering direct customer interactions via voice AI and back-office functions integrated into insurers’ core systems. To mitigate AI errors, Liberate uses an internal monitoring tool called Supervisor, which flags anomalies and escalates issues to humans when necessary. Singh noted the advantage of focusing solely on the insurance industry and specific use cases, enabling robust guardrails for compliance and performance. Though client names remain confidential, Liberate revealed that its AI agents reduced hurricane claim response times from 30 hours to 30 seconds. Additionally, the agents support 24/7 sales operations, allowing customers to purchase insurance during off-hours typically unattended by human agents. Prior to this Series B, Liberate raised $15 million in Series A last year. Investors were attracted by its voice AI–powered omnichannel experience and comprehensive automation via integration with existing systems. Marcus Ryu, general partner at Battery Ventures and incoming Liberate board member, praised the company’s ability to map and model processes while ensuring system connections are robust and designed to fully complete tasks, not just communicate with customers. Ryu’s background includes enterprise software and insurtech investments, notably at Guidewire Software. The new funding will expand Liberate’s reasoning capabilities and accelerate deployments across more insurers. To date, the startup has raised $72 million and employs approximately 50 people.

Watch video about

Liberate Raises $50M to Scale AI Automation in Insurance Operations

Try our premium solution and start getting clients — at no cost to you

I'm your Content Creator.

Let’s make a post or video and publish it on any social media — ready?

Hot news

Adobe Acquires Semrush to Enhance AI Marketing An…

Adobe has taken a major step in the digital marketing and analytics arena by acquiring Semrush for $1.9 billion in cash.

AI Video Conferencing Tools Gain Popularity Amid …

As remote work continues to expand globally, companies are increasingly adopting AI-powered video conferencing tools to enhance communication and collaboration among distributed teams.

The Future of SEO: Integrating AI for Enhanced Se…

The landscape of search engine optimization (SEO) is currently undergoing a profound transformation due to the integration of artificial intelligence (AI).

OpenAI's Sora Model Achieves Milestone in Text-to…

OpenAI has achieved a significant breakthrough with its Sora model, a cutting-edge advancement in text-to-video generation that transforms textual descriptions directly into high-quality videos.

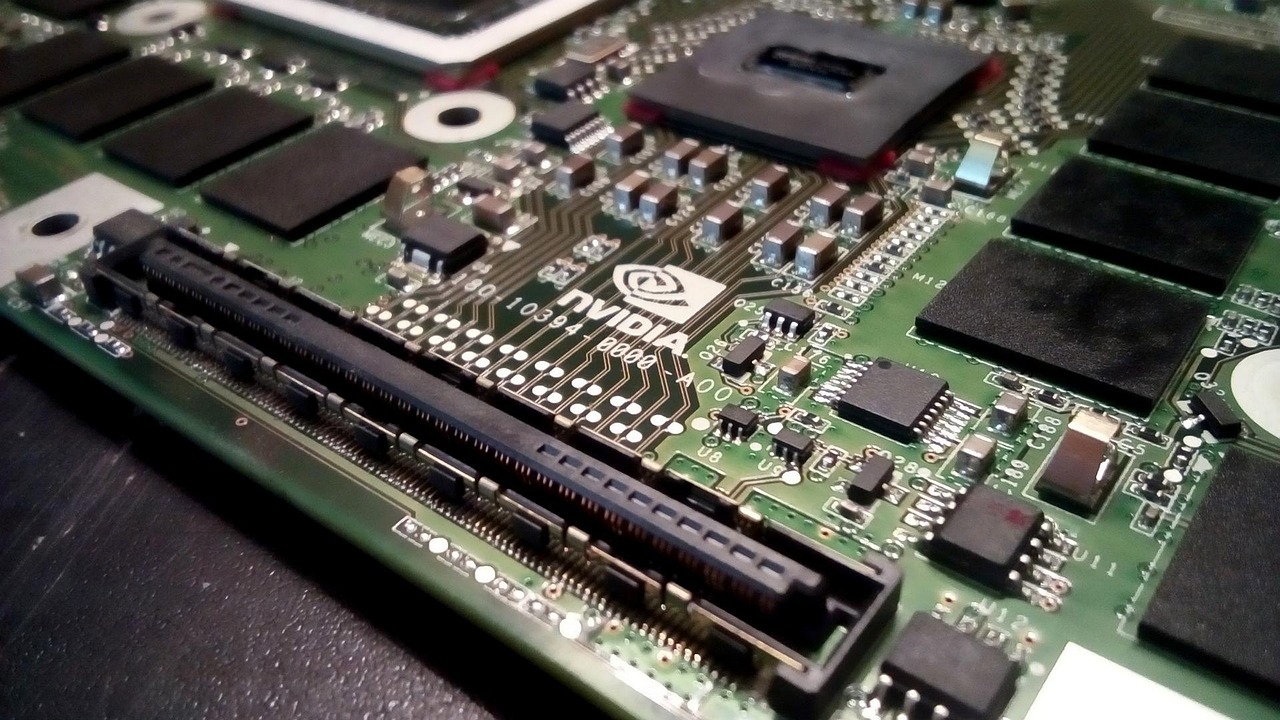

Nvidia AI chip sales to China stalled by US secur…

A necessary component of this site failed to load.

Generative Engine Optimization: A VLM and Agent F…

In the rapidly evolving realm of digital content and artificial intelligence, enhancing search visibility on visual platforms poses significant challenges.

Adobe Acquires Semrush to Enhance AI-Powered Mark…

Adobe Systems Inc., the global software giant known for its creative tools, has announced its acquisition of Semrush, a top provider of digital marketing analytics and SEO software.

AI Company

Launch your AI-powered team to automate Marketing, Sales & Growth

and get clients on autopilot — from social media and search engines. No ads needed

Begin getting your first leads today