Meta Invests $14.8 Billion in Scale AI Amid Antitrust Concerns and Industry Scrutiny

Brief news summary

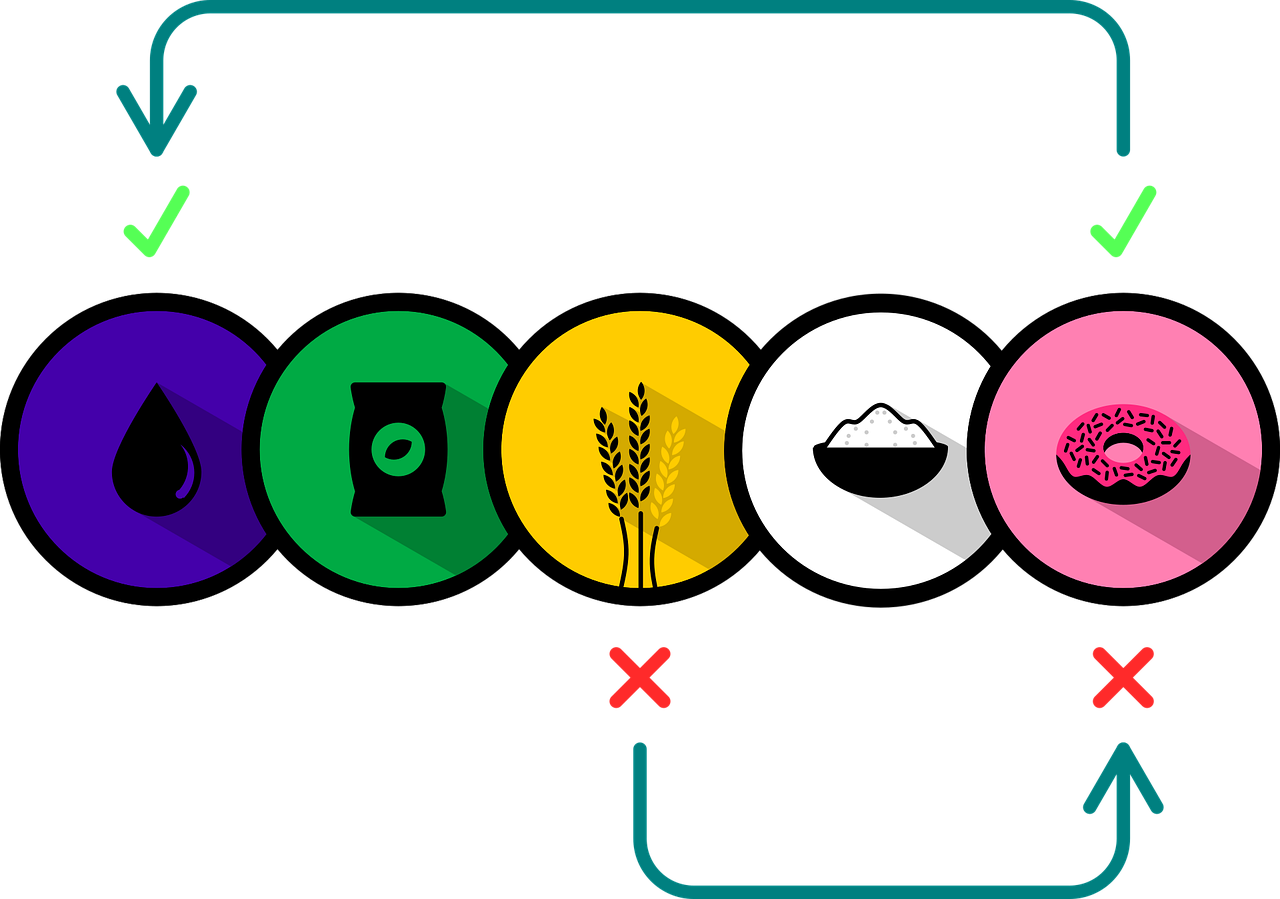

Meta, formerly Facebook, invested $14.8 billion in data-labeling startup Scale AI, acquiring a 49% nonvoting stake—its second-largest investment to date. This deal underscores Meta’s strong commitment to advancing AI technologies while maintaining Scale AI’s operational independence; CEO Alexandr Wang remains on the board but holds limited influence. The transaction was deliberately structured to mitigate antitrust concerns but nevertheless sparked worries over Meta’s growing market power. Senator Elizabeth Warren condemned the investment, calling for investigations into its potential impact on competition. In response, Google ended its collaboration with Scale AI, highlighting rising tensions within the AI industry. This development marks a notable shift from the Trump administration’s laissez-faire approach to the Biden administration’s increased regulatory scrutiny, especially by the FTC. Although there has been no immediate antitrust action, ongoing DOJ investigations and political pressure indicate possible future challenges. Meta’s investment exemplifies the complex relationship between corporate strategy, regulatory oversight, and competitive dynamics in the AI sector, carrying significant implications for antitrust enforcement and innovation.Meta, formerly Facebook, has invested $14. 8 billion in Scale AI, a startup specializing in data-labeling services. This marks Meta’s second-largest investment, emphasizing its strategic focus on advancing artificial intelligence capabilities. The deal, however, has renewed concerns about tech industry practices, especially “acquihire” strategies that may evade antitrust enforcement. Under the agreement, Meta acquired a 49 percent nonvoting stake in Scale AI, granting substantial economic interest without direct control over decisions. Additionally, Scale AI’s CEO, Alexandr Wang, has joined Meta, continuing on Scale’s board with restricted access to maintain operational independence. This structure appears designed to avoid triggering an official antitrust review. Despite these measures, the transaction faces scrutiny from competition regulators worried about its market impact. Critics argue such deals may further consolidate Meta’s dominance in the competitive AI sector.

Senator Elizabeth Warren, a vocal antitrust advocate, opposes the Meta-Scale AI investment, urging investigation due to its potential to unlawfully expand Meta’s market power despite falling outside traditional regulatory parameters. The deal also affects industry dynamics: Google, a key AI competitor, reportedly ended its collaboration with Scale AI following Meta’s involvement, signaling potential client losses for Scale as partners hesitate to engage with a company influenced by Meta. This reveals heightened competitive sensitivities tied to major AI infrastructure and talent investments. This development reflects broader shifts in tech investment strategies amid changing regulatory climates. During President Trump’s administration, tech partnerships faced a looser regulatory environment allowing acquihires that expanded capabilities without deep antitrust scrutiny. By contrast, under President Biden, the FTC has shown increased vigilance, probing similar deals involving Amazon and Microsoft to limit market consolidation. While the FTC has yet to act decisively on the Meta-Scale AI deal, ongoing Department of Justice investigations into Meta’s broader business practices continue amid growing legislative pressure against monopolistic behavior. These legal and political dynamics position the investment as a potential focal point for intensified antitrust enforcement aimed at preserving competition and curbing market dominance. In summary, Meta’s major investment in Scale AI signifies a critical juncture, raising complex issues about corporate strategy, regulatory oversight, and competitive balance in the fast-evolving AI arena. The ensuing regulatory and political reactions will likely signal how future antitrust efforts address similar transactions, shaping innovation and competition within the digital economy.

Watch video about

Meta Invests $14.8 Billion in Scale AI Amid Antitrust Concerns and Industry Scrutiny

Try our premium solution and start getting clients — at no cost to you

I'm your Content Creator.

Let’s make a post or video and publish it on any social media — ready?

Hot news

Independent businesses: have your online sales be…

We would like to learn more about how recent changes in online search behavior, driven by the rise of AI, have impacted your business.

Google Says What To Tell Clients Who Want SEO For…

Google’s Danny Sullivan offered guidance to SEOs dealing with clients eager for updates on AI SEO strategies.

Amid the AI Boom, Supplies of Certain AI Chip Mod…

Amid the rapid advancement of artificial intelligence technology, global supply chains for critical components are under increasing pressure, particularly in the supply of AI chip modules essential for powering advanced AI applications.

Salesforce Agrees to Acquire Qualified for Agenti…

iHeartMedia has teamed up with Viant to introduce programmatic advertising across its streaming audio, broadcast radio, and podcast offerings.

Nvidia's Open Source AI Push: Acquisition and New…

Nvidia has recently announced a major expansion of its open source initiatives, marking a significant milestone in the tech industry.

AI-Generated Videos Gain Popularity on Social Med…

The rise of AI-generated videos is profoundly transforming content sharing on social media platforms.

5 Cultural Attributes That Could Make or Break Yo…

Summary and Rewrite of “The Gist” on AI Transformation and Organizational Culture AI transformation poses primarily a cultural challenge rather than a purely technological one

AI Company

Launch your AI-powered team to automate Marketing, Sales & Growth

and get clients on autopilot — from social media and search engines. No ads needed

Begin getting your first leads today