Kaydka Semiconductor-ka ayaa kor u kacay iyada oo natiijooyinka cajiibka ah ee Q4 ee Micron Technology

Brief news summary

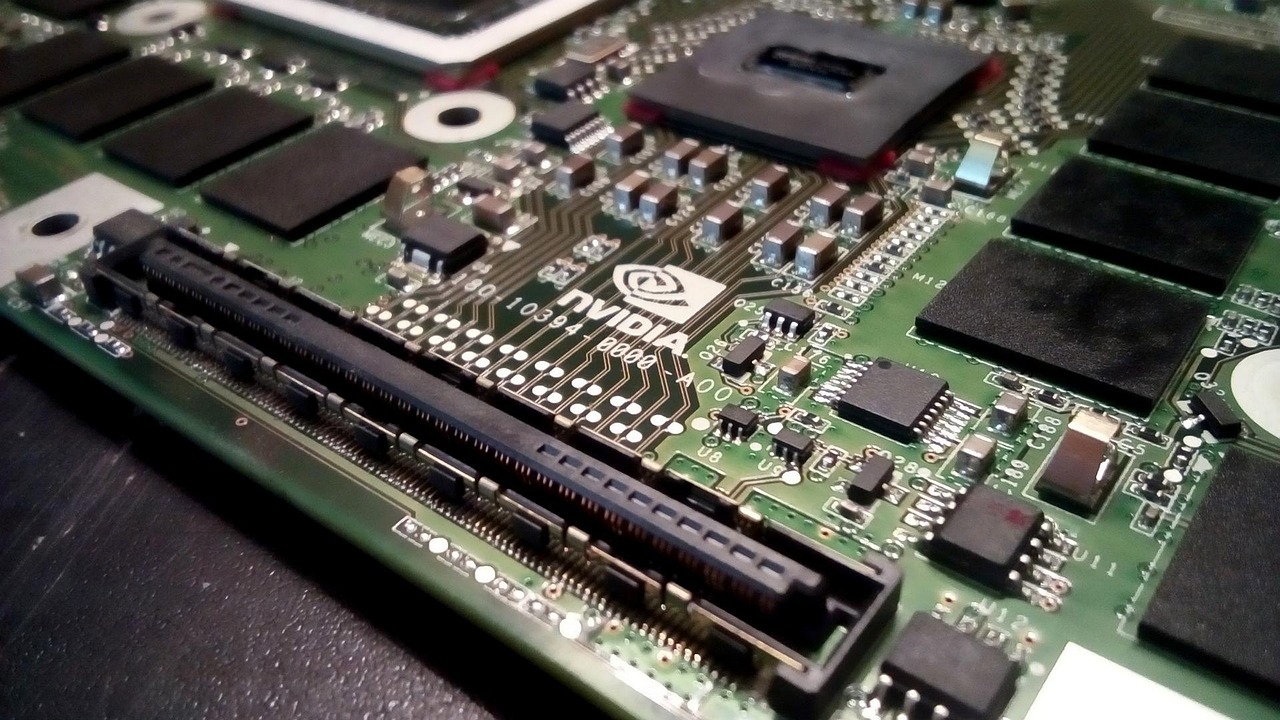

Tan iyo bilowgii sanadkii hore, warshadaha semiconductor-ka ayaa soo jiidatay dareen weyn sababta oo ah xiisaha kordhaysa ee maal gashadayaasha ee sirdoonka artifishalka (AI) iyo baahida loo qabo qalab waxqabad sare leh. Inkasta oo kaydyo AI qaar ay la kulmeen caqabado sababta oo ah maal gashadayaashu waxay raadinayaan calaamado tilmaamaya kororamka sii socda, horumar dhawaanahan ayaa soo kordhiyey rajo. Kaydkayda Taiwan Semiconductor Manufacturing (TSM), ASML Holding, iyo Indie Semiconductor ayaa kor u kacay, oo ku taageeray natiijooyinka dhaqaale ee yaabka leh ee Micron Technology. Dakhliga quarter-ka afraad ee Micron ayaa kor u kacay 93% sanadkiiba-sanadkiiba ilaa $7.75 bilyan, iyadoo ka badan rajadayda falanqeeyayaasha, oo ay kicisay baahida kordhaysa ee xalalka xusuusta ee AI iyo xarumaha xogta (data centers). Waxqabadkan ayaa kordhiyay kalsoonida maal gashadayaasha guud ahaan qeybta semiconductor-ka. Guulaha Micron ayaa yareeyay welwelka ku saabsan hoos u dhaca macquulka ah ee baahida AI, iyadoo faa’iidaysa shirkadaha chip kasoo saarta sida Taiwan Semiconductor, oo diiradda saaraya soo saarista chip-ka, ASML oo bixisa farsamada muhiimka ah ee soosaarka chip-ka, iyo Indie Semiconductor, oo si gaar ah u takhasusay processor-yada gawaarida. Inkasta oo mid kasta uu wajahayo caqabado u gaar ah, rajada suuqa semiconductor-ka ku salaysan AI waxay ahaanaysaa mid waxtar, iyadoo soo jeedinaysa fursadaha korriinka sii socda ee qeybta.Tan iyo bilowgii sanadkii hore, warshadaha semiconductor-ka ayaa soo jiidatay dareen kordhay, gaar ahaan sababta oo ah farxad ku saabsan horumarka ku saabsan sirdoonka artifishalka (AI). Maalgashadayaasha ayaa si firfircoon uga qayb galay qaybtaan, iyadoo uu kiciyo baahida loo qabo qalab casriga oo leh processor-yada ugu dambeeya ee muhiimka ah ee algoridhmada AI. Si kastaba ha ahaatee, ka dib markii ay kor u kaceen aad u weyn, kayd badan oo AI ayaa maraya meel and ku lokaaday maadaama maal gashadayaasha raadinayaan caddayn dheer ee kororka sii socda. Suudka ganacsiga Khamiista, koror yaab leh ayaa lagu arkay: Taiwan Semiconductor Manufacturing (NYSE: TSM) ayaa korodhay qiyaastii 1. 9%, ASML Holding (NASDAQ: ASML) ayaa korodhay 3. 7%, iyo Indie Semiconductor (NASDAQ: INDI) ayaa korodhay 7. 4% ilaa 12:46 p. m. ET. Iyadoo aysan jirin war shirkad gaar ah ama dib-u-habeyn bartilmaameed falanqeeye ah oo sharaxaya kordhinnadan, waxay muuqataa maal gashadayaashu inay ku taageerteen natiijooyinka dhaqaale ee xooggan ee ciyaaryahan kale ee AI, gaar ahaan Micron Technology (NASDAQ: MU). Warbixinta kowaad ee Q4 ee maaliyadeedka sanadka 2024, Micron ayaa shaacisay koror la yaab leh oo 93% sanadkiiba-sanadkiiba heshiis lacag korodhan ah ilaa $7. 75 bilyan, iyadoo la socota kasbashada dalabkii ee layliska saamiyeedka (EPS) oo dhan $1. 18, iyadoo ka soo kabsaday khasaaraha $1. 07 sanadkii hore. Waxqabadka yaabka leh waxaa kiciyay baahida sare ee xusuus ku isticmaashada AI iyo xarumaha xogta (data centers), iyadoo ka badan saadaasha lacagaha iyo EPS ee Wall Street. Saadaasha Micron ee quarter-ka kowaad ee maaliyadeedka 2025 waxay saadaalisay lacag kordhan oo $8. 7 bilyan oo kordhaysa 84% sanadkiiba-sanadkiiba, iyadoo EPS la saadaalinayo inuu kordho 83% ilaa $1. 74.

Hirgelinta jaranjaraynta firfircoonida ee ay taageerayso baahida xooggan ee xarumaha xogta AI (data centers) loogu baahan yahay DRAM memory iyo NAND storage, aad bay usii xaqiiqsiiyeen maal gashadayaasha oo ku saabsan baahida AI ee sii socota. Guusha Micron ayaa u muuqata mid togan comayaasheeda, taasoo muujinaysa in qaadashada korodhan ee AI ay ka faa’iidayaan shirkadaha si gaar ah u takhasusay semiconductor-yada ku habboon. Tusaale ahaan, Taiwan Semiconductor waa chip-maker ka ugu weyn adduunka, iyadoo leh koritaan xooggan sababta oo ah baahida sare ee chips-ka ugu dambeeya, halka ASML ay tahay shirkadda kali ah ee bixisa qalabka lithography ee muhiimka ah ee loogu talagalay soo saarista chip-ka ugu sareeya. Dhanka kale, Indie Semiconductor waxay diiradda saartaa processor-yada gawaarida iyo horumarinta xalalka AI ee loogu talagalay soo saarayaasha baabuurta. Ugu dambeyn, natiijooyinka xooggan ee Micron waa inay dejin doonaan welwelka ku saabsan hoos u dhaca baahida AI iyo inay ku dhiirigeliso kalsoonida shirkadihii la xiriiray. Xirfadaha malamayda ah, kayd sida Taiwan Semiconductor iyo ASML waxay muuqdaan inay si macquul ah u qiimeysan yihiin iyadoo la eegayo earnings-ka la saadaalinayo, halka Indie Semiconductor ay helayaan khatar dheeraad ah sababta oo ah la'aanta faa'iido. Mid kasta oo ka mid ah kaydkani waxay soo bandhigayaan fursado xiiso leh iyadoo la ballaarinayo qaybta AI. Ka hor intaan la maalgelin Taiwan Semiconductor Manufacturing, maal gashadayaashii suurtogalka ah waa inay si taxaddar leh u qiimeeyaan xalalkooda. The Motley Fool's Stock Advisor waxay soo jeediyeen kayd ay aaminsan yihiin inay ballan weyn ka qabaan, taasoo iftiiminaysa muhiimadda cilmi baaris qoto dheer marka la eegointa maalgelinta qaybtaan firfircoon.

Watch video about

Kaydka Semiconductor-ka ayaa kor u kacay iyada oo natiijooyinka cajiibka ah ee Q4 ee Micron Technology

Try our premium solution and start getting clients — at no cost to you

I'm your Content Creator.

Let’s make a post or video and publish it on any social media — ready?

Hot news

Adobe ayaa iibsaday Semrush si uu u horumariyo fa…

Adobe ayaa qaaday tallaabo weyn oo ku saabsan suuq-geynta dijitaalka ah iyo falanqaynta iyadoo Iibsatay Semrush qiimihiisu yahay $1.9 bilyan oo doollar lacag caddaan ah.

Qalabka Wadahadalka Muuqaalka ee AI ayaa caan aha…

Marka shaqada fog ee sii balaadhaysa caalamka oo dhan, shirkaduhu si weyn ayay u qaadanayaan aaladaha shirarka fiidiyowga ee ku shaqeeya AI si loo xoojiyo isgaarsiinta iyo wada shaqaynta kooxaha kala firdhiday.

Mustaqbalka SEO: Isdhexgalka AI si loo xoojiyo ka…

Muuqaalka optimizing-ka mashiinka raadinta (SEO) ayaa hadda wajahaya isbeddel ballaaran oo qoto dheer sababtoo ah isdhexgalka sirdoonka artificial (AI).

Qaabka Sora ee OpenAI ayaa gaaray horumar muhiim …

OpenAI ayaa gaaray horumar weyn oo la taaban karo oo ku saabsan qaabka Sora, horumar casri ah oo ku saabsan abuurista muuqaalada qoraalka laga soo saaro, kaas oo si toos ah u beddelaya sharraxaadaha qoraalka ah muuqaalo tayo sare leh.

Iibinta chip-ka AI ee Nvidia ee Shiinaha ayaa hak…

Qayb muhiim ah oo ka mid ah goobtan ayaa ku guul darreystay inay soo degto.

Hagaajinta Makiinada Abuurista: Qaab-dhismeedka V…

In goobta si dhakhso ah isu beddelaya ee nuxurka dijitaalka ah iyo garaadka macmalka ah, kor u qaadida muuqaalka raadinta ee barnaamijyada muuqaalka ah ayaa leh caqabado waaweyn.

Adobe ayaa Iibsaday Semrush si loo xoojiyo Falanq…

Adobe Systems Inc., oo ah shirkadda weyn ee software-ka caalamiga ah ee loo yaqaan aaladaha hal-abuurka, waxay ku dhawaaqday inay soo iibsateen Semrush, oo ah bixiyaha ugu sareeya ee falanqaynta suuqgeynta dijitaalka ah iyo software-ka SEO.

AI Company

Launch your AI-powered team to automate Marketing, Sales & Growth

and get clients on autopilot — from social media and search engines. No ads needed

Begin getting your first leads today