None

Brief news summary

Billionaire investor David Tepper has showcased his investment prowess with a successful bet on Nvidia, which led to a threefold increase in the company's shares. Tepper has now shifted his focus to the AI sector, making strategic moves in three top AI stocks while reducing his position in Nvidia. Tepper's first new investment is Oracle, which now ranks as the 12th largest holding in his portfolio. Oracle's promising growth prospects and partnerships with Nvidia and Microsoft make it an attractive choice in the AI market. In the fourth quarter, Oracle experienced a significant 16% surge in adjusted earnings per share. Additionally, Tepper has significantly increased his stake in Alibaba Group Holding, a key player in the Chinese markets. Despite recent setbacks, Tepper believes in the potential for a rebound as Alibaba's shares are currently trading at a low multiple of 7.8 times forward earnings, making it a compelling investment. Tepper has also raised his stake in Amazon, solidifying its position as the third-largest holding in his portfolio. He sees great potential in Amazon due to its strong earnings, growth in free cash flow, and opportunities in Amazon Web Services, particularly in generative AI. Amazon's expansion into sectors like healthcare further adds to its appeal and makes it an enticing investment choice. It is worth noting that Tepper's investments not only demonstrate the growth potential and value proposition of these AI stocks but also make them highly appealing to other investors.David Tepper, a billionaire investor with a net worth of $20. 6 billion, has demonstrated his ability to make money through strategic investments. One notable example is his sizable position in Nvidia, which he initiated in the first quarter of 2023 and saw substantial gains by year-end. Nvidia now ranks as the fourth-largest holding in Tepper's portfolio at Appaloosa Management. In the fourth quarter of 2023, Tepper focused on several artificial intelligence (AI) stocks but reduced his stake in Nvidia by nearly 23%. Instead, he increased his position in three other AI stocks. Let's take a closer look at these investments. 1. Oracle Oracle was not a part of Appaloosa's portfolio before the fourth quarter, but Tepper invested around $140 million in the stock during that period. This move propelled Oracle to become the 12th-largest holding in the portfolio. Tepper likely values Oracle's growth prospects, as the company's adjusted earnings per share saw a significant 16% increase year over year in Q4. Additionally, the company's cloud infrastructure is attracting a growing number of customers, driven by the demand for generative AI solutions. Oracle's low price-to-earnings-to-growth (PEG) ratio of 1. 08x makes it an appealing AI stock for investors, especially considering its smart partnerships with Nvidia and Microsoft. 2.

Alibaba Group Holding Tepper also augmented Appaloosa's stake in Alibaba Group Holding by almost 21% in Q4. This Chinese tech giant is now the sixth-largest position in the hedge fund's portfolio. Despite Alibaba's slower growth due to economic conditions and setbacks in executing its strategy, Tepper sees potential in the company. Its shares are currently trading at a modest multiple of only 7. 8 times forward earnings, which does not fully reflect its underlying business strength. Patient investors with an appetite for risk could potentially reap significant long-term gains with Alibaba, although caution is advised due to the uncertainties associated with investing in Chinese stocks. 3. Amazon Appaloosa increased its stake in Amazon by over 5%, making it the third-largest position in the fund's portfolio. Tepper has been a long-time supporter of Amazon, first investing in the stock in Q1 of 2019. The company's strong earnings and free-cash-flow growth contribute to Tepper's continued confidence, alongside the promising opportunities presented by Amazon Web Services in the generative AI field. Furthermore, Amazon's expansion into new sectors, including healthcare, adds even more potential for growth and should not be overlooked by investors. In conclusion, David Tepper's investment decisions in the AI sector, particularly his positions in Oracle, Alibaba, and Amazon, demonstrate his ability to identify promising opportunities for long-term gains. These investments could be of interest to a wide range of investors, but it is important to consider the associated risk factors and conduct thorough research before making any investment decisions.

Watch video about

None

Try our premium solution and start getting clients — at no cost to you

I'm your Content Creator.

Let’s make a post or video and publish it on any social media — ready?

Hot news

Why 2026 could be the year of anti-AI marketing

A version of this story appeared in CNN Business’ Nightcap newsletter.

AI-Driven SEO: A Game Changer for Small Businesses

In today’s rapidly evolving digital marketplace, small businesses often struggle to compete with larger enterprises due to the extensive resources and advanced technologies big companies utilize for online visibility and customer attraction.

Nvidia Acquires SchedMD to Enhance Open-Source AI…

Nvidia, a global leader in graphics processing technology and artificial intelligence, has announced the acquisition of SchedMD, a software company specializing in AI software solutions.

Business leaders agree AI is the future. They jus…

Business leaders across diverse industries continue to view generative artificial intelligence (AI) as a transformative force capable of reshaping operations, customer engagement, and strategic decision-making.

AI-Enhanced Video Conferencing: Improving Remote …

In today’s rapidly evolving environment of remote work and virtual communication, video conferencing platforms are advancing significantly by incorporating sophisticated artificial intelligence (AI) features.

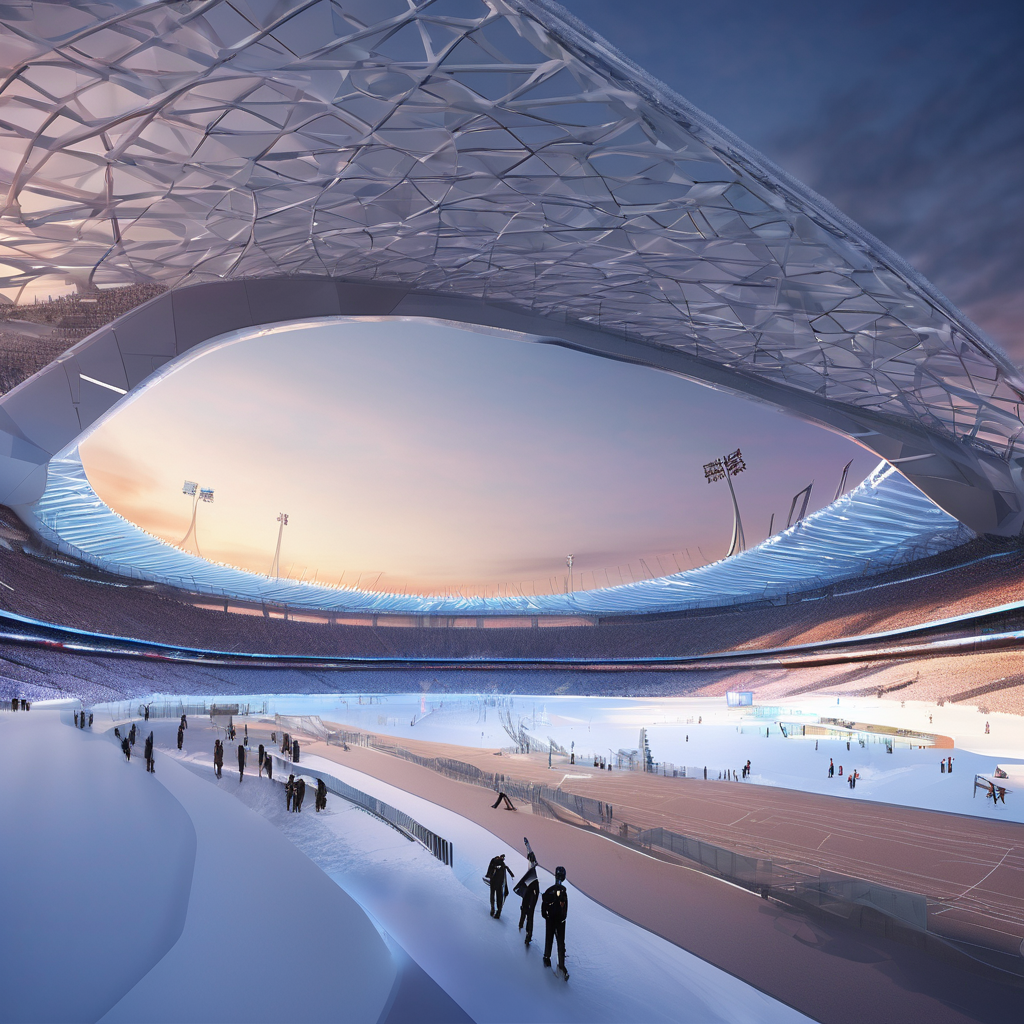

IOC Integrates Advanced AI Technologies for 2026 …

The International Olympic Committee (IOC) intends to implement advanced artificial intelligence (AI) technologies in upcoming Olympic Games to enhance operational efficiency and improve the viewer experience.

Zeta Global (NYSE: ZETA) spotlights Athena AI mar…

Zeta Global Announces Exclusive CES 2026 Programming, Showcasing AI-Powered Marketing and Athena Evolution December 15, 2025 – LAS VEGAS – Zeta Global (NYSE: ZETA), the AI Marketing Cloud, revealed its plans for CES 2026, featuring an exclusive happy hour and fireside chat in its Athena suite

AI Company

Launch your AI-powered team to automate Marketing, Sales & Growth

and get clients on autopilot — from social media and search engines. No ads needed

Begin getting your first leads today