JPMorgan Launches Blockchain Pilot to Tokenize Carbon Credits for Enhanced Market Transparency

JPMorgan Chase & Co.

(JPM) is developing a blockchain-based system to tokenize carbon credits, aiming to enhance tracking, transparency, and trading efficiency within carbon markets. What Happened: JPMorgan’s blockchain unit, Kinexys, is partnering with S&P Global Commodity Insights, EcoRegistry, and the International Carbon Registry to initiate a pilot program, according to Bloomberg. This trial will examine whether blockchain technology can effectively track carbon credits from issuance through retirement, potentially minimizing market inefficiencies and improving traceability. Tokenization is rapidly expanding across financial markets, with major firms like BlackRock (BLK) and Deutsche Bank (DB) exploring digital versions of tangible assets such as stocks and Treasury bills to simplify trade settlements. JPMorgan sees applying similar digital innovations to voluntary carbon markets as a way to tackle persistent issues including fragmented systems, inconsistent standards, and low transparency. In a statement, the bank emphasized that a unified blockchain framework could facilitate smoother movement of carbon credits between buyers and sellers. “The voluntary carbon market is ripe for innovation, ” said Alastair Northway, head of natural resource advisory at JPMorgan Payments. He added that blockchain tokenization could develop a globally compatible system, boosting trust, price visibility, and market liquidity. Carbon credits generally represent one metric ton of carbon dioxide prevented from entering or removed from the atmosphere—often via renewable energy or forestry initiatives. By tokenizing these credits, digital versions recorded on a blockchain would make them easier to verify and trade. Why It Matters: While carbon markets are designed to support environmental projects and direct investment toward developing economies, they have faced criticism. Concerns about greenwashing and instances where projects failed to deliver promised emissions reductions have questioned the sector's credibility. Despite these challenges, financial entities and governments remain committed to advancing carbon markets. JPMorgan, which has funded carbon initiatives and purchased carbon removal credits, seeks to establish leadership in this area. In a report released Wednesday, JPMorgan called carbon markets an emerging asset class with growth potential, contingent on improved infrastructure and ongoing innovation. However, the bank warned that without these advances, the market could suffer further losses in credibility and demand. JPMorgan also pointed out that previous tokenization efforts by others raised issues related to double-counting and misuse of retired credits. Read Next: Bitcoin To Hit $200, 000 In 2025, But New ETH, SOL Highs Remain In Doubt, Bitwise Says Image: Shutterstock

Brief news summary

JPMorgan Chase & Co. is creating a blockchain-based platform to tokenize carbon credits, aiming to improve transparency, tracking, and trading efficiency within carbon markets. Through its Kinexys blockchain division, JPMorgan is collaborating with S&P Global Commodity Insights, EcoRegistry, and the International Carbon Registry to pilot a system that tracks carbon credits throughout their lifecycle—from issuance to retirement. Tokenization digitizes credits on the blockchain, a method increasingly adopted by major firms like BlackRock and Deutsche Bank for managing real assets. JPMorgan’s goal is to unify fragmented carbon markets, raise standards, and simplify transactions, enhancing trust, price transparency, and liquidity. Carbon credits, representing one metric ton of CO2 reduction, have faced criticism related to greenwashing and unverifiable claims. Recognizing carbon markets as a growing asset class needing better infrastructure, JPMorgan’s platform aims to prevent issues such as double-counting and misuse of retired credits, thereby strengthening market integrity.

AI-powered Lead Generation in Social Media

and Search Engines

Let AI take control and automatically generate leads for you!

I'm your Content Manager, ready to handle your first test assignment

Learn how AI can help your business.

Let’s talk!

Hot news

Rise of AI Companions Among Single Virginians

New data from Match reveals that 18% of single Virginians have incorporated artificial intelligence (AI) into their romantic lives, a significant increase from 6% the previous year.

Ponzi VCs Are Strangling Blockchain

According to Romeo Kuok, a board member at BGX Ventures, most deals are structured to facilitate quick exits instead of generating long-term enterprise revenue.

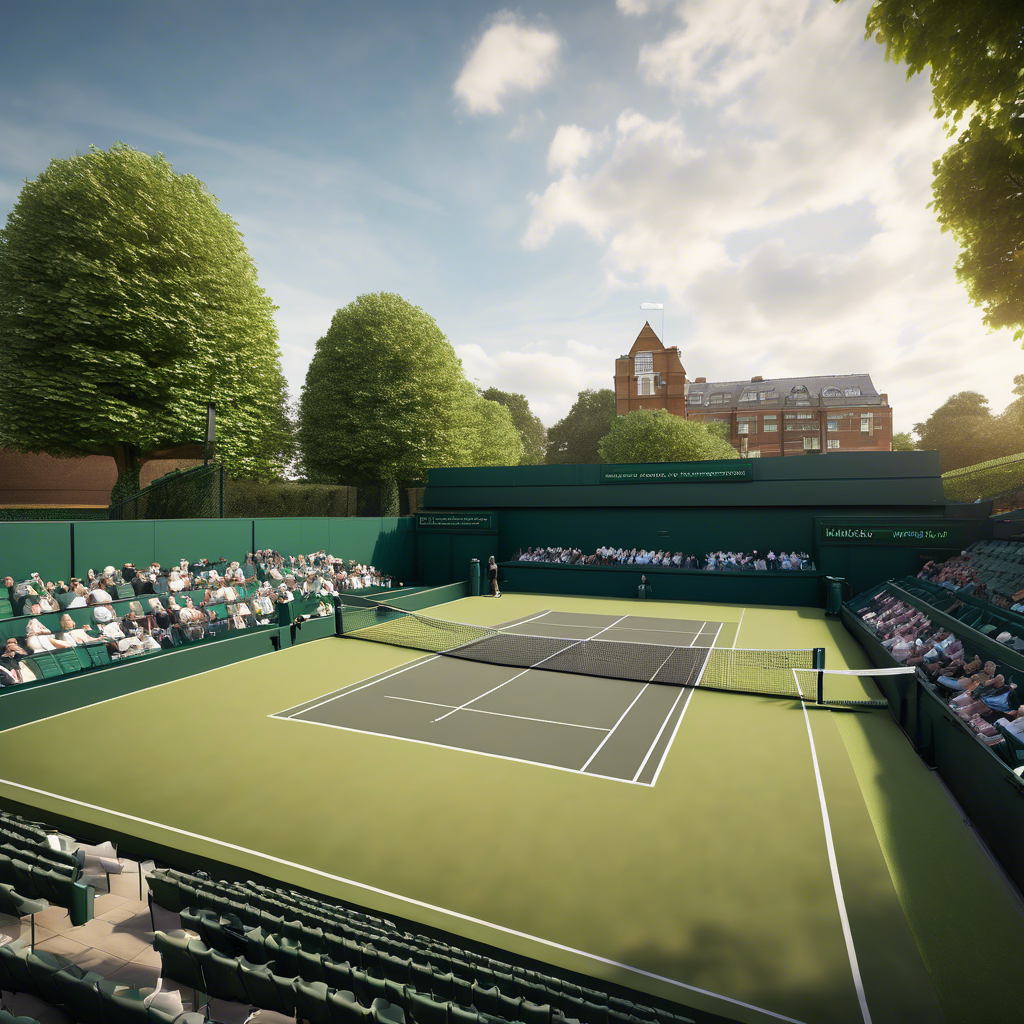

Wimbledon's AI Judges Receive Mixed Reviews from …

The All England Club made a landmark change at Wimbledon 2025 by replacing traditional line judges with the AI-powered Hawk-Eye Electronic Line Calling (ELC) system.

The ECB Approves Two Blockchain Projects To Moder…

The European Central Bank is embarking on a significant technological transformation.

Nvidia's Power Play

Nvidia, a leading technology company known for graphics processing and artificial intelligence, has announced a strategic partnership to launch Emerald AI, an innovative startup focused on sustainable energy management in data centers.

Senate Strikes AI Provision from GOP Bill After U…

On July 1, 2025, the U.S. Senate overwhelmingly voted 99 to 1 to remove a controversial provision from President Donald Trump's legislative package that sought a nationwide moratorium on state-level AI regulation.

Tokenizing Stocks: A New Frontier in Blockchain I…

Coinbase, a leading cryptocurrency exchange, has taken a major step toward reshaping traditional stock trading by seeking approval from the U.S. Securities and Exchange Commission (SEC) to offer tokenized equities.

Auto-Filling SEO Website as a Gift

Auto-Filling SEO Website as a Gift

Auto-Filling SEO Website as a Gift

Auto-Filling SEO Website as a Gift